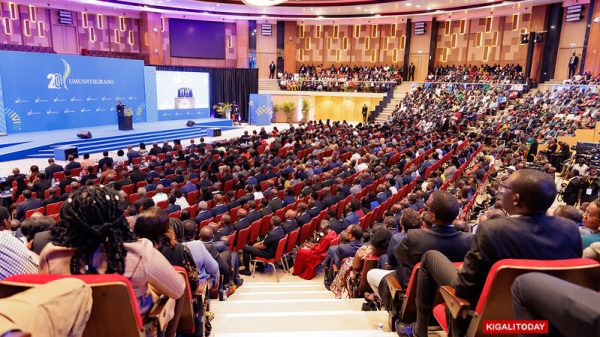

Couple of days after Rwanda’s annual #Umushikirano2026, which took place in Kigali on February 5 & 6, 2026, its Twelve Resolutions have been published by the Office of the Government Spokesperson, grouped in three pillars: Economy, Social and Governance.

Like previous similar national meetings, these resolutions will be followed concrete actions to be taken immediately by concerned institutions. The last year’s 19th #Umushyikirano2025 made 13 resolutions, translating into 41 actions. At the beginning of the next year’s #Umushyikirano, the chief of the government -Prime Minister- will report back on the results.

At this 20th national dialogue, two well-known creatives — journalist Scovia Mutesi and musician Bruce Melodie — raised a matter that has been quietly building for years: monetization on global digital platforms.

It is important to note and salute the fact that this matter was considered among the said twelve resolutions as its 9th under the social pillar in the following terms: “Support Rwandan content creators and creatives to effectively monetize digital platforms and online content.”

Scovia and Bruce spoke about lost revenue, missed opportunities, and the uncomfortable reality of having to “borrow” foreign countries in order to activate monetization features on major platforms driving this economy like YouTube, TikTok, Instagram, Patreon, LinkedIn and many others.

Their concern was not that they are unable to earn money at all. In fact, they and many leading Rwandan creators already generate considerable income from these platforms through various arrangements. Ms Mutesi told the gathering she had established her television station -Mama u rwa Gasabo – with her own funding generated from social platforms income. The issue is deeper. It is about where that income is recognized, processed, recorded, taxed, and reinvested. It wasn’t about seeking any government’s support. It is about whether Rwanda as a country is fully integrated into the formal global monetization system — and whether it is capturing the economic value created by its own digital talent.

The 9th resolution of #Umushyikirano2026 for “…Rwandan content creators and creatives to effectively monetize digital platforms and online content” — is an important acknowledgment, but a strong economic matter.

The wake-up call is therefore not only for the Ministry of ICT. It is more urgently for the Ministry of Finance and Economic Planning, the Rwanda Development Board, the Rwanda Revenue Authority, the National Institute of Statistics of Rwanda, and the National Bank of Rwanda.

The Global Creator Economy Is Big Business

Globally, the creator economy was valued at 250 billion in 2025 and is projected to grow double that amount by 2027.

In the United States and Canada, platform monetization is fully integrated into banking systems, tax systems, and national statistics. A creator uploads content on YouTube, qualifies for the YouTube Partner Program, and receives AdSense revenue directly into a verified local bank account.

That income is taxable, measurable, and considered part of the digital services sector.

In North America, average YouTube revenue per thousand views often ranges between three and eight dollars depending on niche and audience geography. That means a single viral video can generate substantial income not only for the individual creator but also for the national economy through taxation and financial circulation.

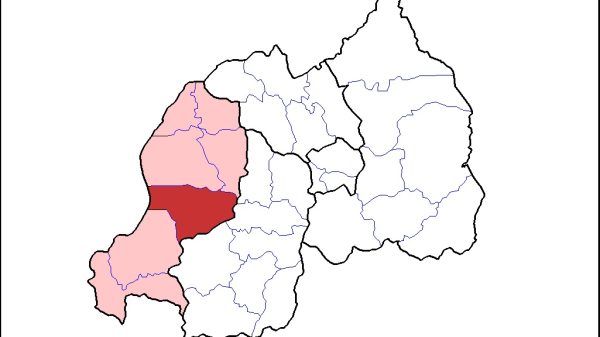

In Africa, the situation varies. Kenya, Nigeria, and South Africa are recognized monetized markets on major platforms. Kenya in particular has developed a visible digital content ecosystem supported by mobile money integration, advertising adoption by local businesses, and increasing regulatory clarity around digital income. Kenyan creators can receive platform payouts directly into compliant financial channels, and those earnings form part of the country’s digital economy statistics.

Rwanda, despite strong digital ambitions and impressive ICT infrastructure, remains in a different category in practice when it comes to full platform monetization integration.

What Monetization Really Means

Monetization is not just about earning money. It is about structured participation in a global advertising and payment system.

When a country is fully monetized, creators can:

Open and verify monetized accounts without using foreign addresses.

Receive AdSense or platform payouts directly into domestic financial institutions.

Have income formally recorded within the national financial system.

Pay taxes transparently and access financial services based on documented digital income.

When monetization is not locally structured, creators often use alternative arrangements. They may register accounts under another country, rely on intermediaries abroad, or use foreign banking channels. The income still comes, but it does not flow cleanly through Rwanda’s economic system. That creates leakage.

A Concrete Example: Four Million Views

Consider a YouTube video that reaches four million views.

In a monetized country like Kenya, average revenue might be around one dollar per thousand views ($ 1 = 1,000 views). This is known as Revenue Per Mille (RPM), and varies depending on the country’s advertising market value. At that rate, four million views -viewed locally- could generate approximately four thousand dollars in advertisement revenue alone (4 million views = $ 4,000). The advertisement market considered here is the consumption, not the one of publication. So, in the same sector where RPM is $ 1/1000 views, in the US or Canada it could be $ 8/1000 views, and if the same video is viewed by 4 million people in America and or Canda, it will generate $ 32,000 in revenue for the creator and the local economy. Back to modest revenue of $ 4K, that money enters the Kenyan banking system, it is potentially taxed, supports household consumption, and may be reinvested into production equipment, staff, or new creative ventures.

In Rwanda, a creator with the same $ 4 million views can still earn revenue if they have found a workaround to activate monetization. However, the payout is often processed outside Rwanda’s formal systems. The country does not fully capture the transaction in its financial statistics. Tax authorities may not clearly track the income. National accounts may not classify it properly as digital exports. The creator earns, but the economy does not fully register the gain.

Multiply that example by hundreds of creators and thousands of videos over several years, and the cumulative loss becomes significant.

What Monetized Countries Gain

Monetized countries gain measurable digital export revenue. When viewers in Europe, North America, or Asia watch African content, advertising money flows back to the creator’s country. That is a form of service export.

They gain taxable income streams from creators. Tax bodies can broaden the tax base organically without aggressive new tax instruments.

They gain better data. Statistical agencies can measure the creative digital sector accurately, which informs planning, budgeting, and policy design.

They gain investor confidence. Banks and venture capital firms are more willing to finance creators who can show formal, documented income streams.

What Rwanda Risks Losing

Rwanda risks underestimating the size of its own digital economy. If creator revenues are not formally integrated, the National Institute of Statistics cannot fully account for them. That affects GDP measurement and sectoral planning.

The Rwanda Revenue Authority loses visibility into a growing income stream at a time when it consistently speaks about expanding the tax base.

The National Bank of Rwanda misses an opportunity to modernize payout systems in alignment with global platform standards, strengthening cross-border digital payments and foreign currency inflows.

Most importantly, Rwanda risks psychologically classifying the creator economy as any other informal venture rather than as a legitimate economic sector.

A Necessary Mental Shift

The resolution under the Social pillar sends a supportive message. But monetization belongs equally, if not more strongly, under the Economy pillar.

The interventions by Scovia Mutesi and Bruce Melodie should be interpreted as a strategic economic signal. They are not merely complaining about platform policies. They are highlighting structural economic inefficiencies.

The Ministry of Finance and Economic Planning must treat creator monetization as a revenue and export issue. The Rwanda Revenue Authority should develop clear frameworks for digital income declaration that encourage compliance rather than ambiguity. The National Institute of Statistics should begin measuring digital creator activity as a formal sub-sector. The National Bank of Rwanda should streamline payout recognition and foreign currency settlement mechanisms to align with global social platforms.

A dedicated high-level focal point interfacing directly with major platforms, and coordinating with all the above agencies could accelerate technical clarifications and ensure Rwanda meets all operational requirements in practice, not only in principle. These platforms prefer clear and stable interlocutor. Rwanda has done this before, and on numerous successful occasions.

Monetization Is Economic Infrastructure

Rwandan creators are already participating in the global creator economy. They are not waiting. They are innovating, adapting, and earning.

The real question is whether Rwanda’s economic institutions are fully aligned to capture, measure, tax, and reinvest that value within the national system.

Monetization is not about pride or optics. It is about financial flows, export earnings, tax base expansion, statistical visibility, and economic modernization.

If Rwanda positions creator monetization squarely within economic policy — rather than leaving it framed mainly as a social support measure — it can transform a perceived frustration into a strategic growth opportunity.

X: @semukanyam